The housing market in 2023 remains heavily influenced by mortgage rates, which are currently showing a positive trend. As we enter the new year, mortgage rates continue to decline, which is good news for buyers and sellers alike.

-Read the full article at TheAgency.com

For an in-depth analysis of what the Federal Reserve's latest moves may mean for buyers, sellers, and this month's economic news, turn to The Agency's preferred mortgage partner, Cross Country Mortgage, who provide valuable insight:

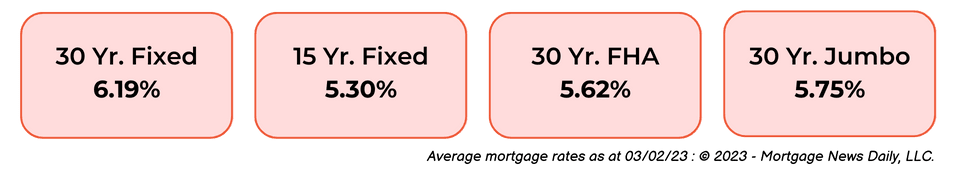

On February 1st, the Fed raised the Fed Funds Rate by a quarter of a point as expected, but it was their commentary on inflation, recession, job growth, and upcoming hikes that garnered the most attention. While the Fed indicated that there was still a need for ongoing rate increases, mortgage-backed securities reacted positively to the news, resulting in a drop in mortgage rates. This aligns with our previous predictions that mortgage rates will follow inflation downward over the next few months and throughout 2023. However, it's worth noting that the strong job growth in the economy pushed mortgage rates a little higher this week after the market digested the news. Below are the average rates as of February 7th, along with commentary on the current unemployment numbers.

The Fed is expected to raise the Fed Funds Rate by another 0.25 basis points at its upcoming meeting on March 22nd, 2023.

According to the latest data from the S&P CoreLogic Case-Shiller Index, home price growth in the United States has slowed down. In November 2022, home prices recorded an annual gain of 7.7%, which is a decline from 9.2% in October. This marks the eighth consecutive month of shrinking gains. The 20-city home price index and the 10-city composite index posted a year-over-year gain of 6.8% and 6.3%, respectively. While Miami and Tampa had the highest annual price gains at 18.4% and 16.9%, San Francisco recorded a negative result of -1.6%, which is the first in over 10 years. On the bright side, pending home sales increased due to a 6.4% rise in the West and a 6.1% pickup in the South. The decline in mortgage rates, which play a crucial role in the home sales market, is contributing to its stabilization.

The latest jobs report released on February 4th exceeded expectations and showed exceptional progress in the US economy. A record-breaking 517,000 jobs were added in January, resulting in a drop in the unemployment rate to 3.4%, the lowest it has been in over 50 years. This positive outcome, which more than doubled the predicted 190,000 jobs, came as a surprise, especially as the Federal Reserve has been attempting to slow down the labor market. The report also revealed that average hourly earnings increased by 0.3% or 4.4% compared to the previous year in January. However, despite strong employment potentially boosting housing activity, factors like weak wage growth and rising inflation may limit investment.

Although the Federal Reserve's monetary policy officials may be close to ending their tightening cycle, the recent job numbers make it more likely that the Fed will keep interest rates higher for a longer period. As a result of this news, mortgage rates have slightly increased to their highest levels in the past month. Nonetheless, we anticipate that mortgage rates will remain volatile but overall continue to fall over the course of the year.

The economic shock caused by high mortgage rates has been consistently declining since December due to the increasing signs of decelerating inflation. As financial markets loosen, mortgage rates are falling, making the housing market more accessible. The 30-year fixed mortgage rate is at its lowest level since September 2022, which can be attributed to Federal Chair Jerome Powell's shift in language regarding inflation. This trend towards lower mortgage rates is driving more interest from potential buyers. According to CoreLogic and Zillow, the tight inventory environment will likely contain any home price correction going forward.

-For more information go to Cross Country Mortgage

Below is an interview with Steve Maizes of Cross Country Mortgage:

Please note that we are not licensed mortgage brokers and do not provide any professional mortgage advice. All information provided is reworded from reliable sources, such as Cross Country Mortgage, for informational purposes only. Any decisions made based on this information are solely at your own risk and we recommend seeking advice from a licensed mortgage broker or financial advisor before making any important financial decisions.